How to Apply for Your St.George Vertigo Credit Card

The St.George Vertigo Credit Card offers low interest rates and valuable perks, making it a great option for Australians. Learn about its benefits ...

How to Apply for Your NAB StraightUp Card

The NAB StraightUp Card offers no interest charges or late fees, making it a simple and transparent option for those seeking an easy-to-manage cred...

How to Apply for Your NAB Low Fee Card

The NAB Low Fee Card offers a cost-effective solution with minimal annual fees, ideal for individuals seeking a simple and affordable way to manage...

How to Apply for Your NAB Low Rate Credit Card

The NAB Low Rate Credit Card offers low interest rates and essential features, making it a great option for those looking to minimize interest expe...

How to Apply for Your RateSaver Credit Card

The RateSaver Credit Card from Macquarie offers low interest rates, no international fees, and a competitive annual fee, making it ideal for cost-c...

How to Apply for Your Kogan Money Credit Card

The Kogan Money Credit Card offers no annual fee and significant points on daily purchases, making it a convenient and rewarding option for modern ...

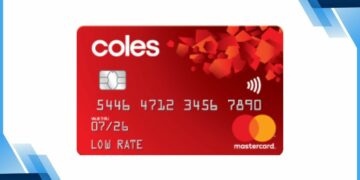

How to Apply for Your Low Rate Mastercard

The Low Rate Mastercard from Coles offers low fees, reward points, and flexible repayments. Learn how to apply and explore its key benefits for a s...

How to Apply for Your Coles No Annual Fee Mastercard

The Coles No Annual Fee Mastercard offers rewards, flexible payments, and strong security without annual fees, making it a practical choice for eve...

How to Apply for Your Citi Simplicity Card

The Citi Simplicity Card offers no annual fees or late payment charges, making it a straightforward and uncomplicated credit solution for easy fina...

Frequently Asked Questions

What inspired the creation of Renda e Dinheiro?

Renda e Dinheiro was established to help those looking for greater peace of mind and security in their daily finances. We believe that by having access to the right information and guidance, anyone can manage their budget more effectively, make informed choices, and work toward medium- and long-term goals—such as saving, investing, or even fulfilling personal dreams. Our mission is to make financial management straightforward and accessible, so you can enjoy a more balanced financial life.

How do you maintain the accuracy of the information provided?

Each piece of content goes through a meticulous vetting process. Our team consists of professionals and contributors dedicated to ensuring data is current, credible, and presented in an easily understandable format. We believe that ethical standards and transparency are vital to earning and keeping your trust.

Does Renda e Dinheiro work in collaboration with any banks or financial institutions?

No. Our independence is key to providing honest, unbiased evaluations of financial products and services. If we ever recommend specific resources, it’s because our analysis shows they may benefit our readers—not due to any external sponsorship or obligations.

In what way is Renda e Dinheiro funded?

We sustain our operations through partnerships and advertisements. Even so, we’re committed to ensuring these partnerships never compromise the objectivity or usefulness of our articles. Our foremost priority is offering content that aids you in navigating your financial journey confidently.

Do I need to supply personal data to access the site’s materials?

Not at all. We never ask for confidential details, such as banking or personal identification information. If anyone contacts you claiming to be from Renda e Dinheiro and requests such data, please disregard the message. Our emphasis is on presenting reliable financial insights without placing you at any risk.